DOZENS of ageing Hunter residents, victims of fraudster Newcastle accountant Ray Walker, have officially been told their life savings are gone, some now face losing their homes.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

At best, they will be returned 10 cents in the dollar after a bankruptcy trustee investigation, hampered by missing books and records, has been unable to trace the majority of money stolen by Walker over decades.

In his latest report to creditors, bankruptcy trustee Ray Tolcher revealed this month that there was only $1.1 million left for more than 70 known creditors, owed about $11 million.

Walker’s victims, the majority from the Hunter, are mostly ageing retirees and pensioners, who saved a lifetime to build nest eggs and superannuation funds, only to have it stolen by a man who masqueraded as their "trusted accountant" and "friend".

Some had known him since childhood.

Craig McDonald, a medically retired underground coalminer, whose extended family is owed $1.4 million and likely to receive $140,000, described the news as "unbelievable".

- READ MORE: Ray Walker's fraud victims still suffering

He called on the Walker family to do more to help victims, many who are elderly and have been left in dire financial crisis.

Some face losing their homes and others, well into their 70s, have been forced to cut short their retirement and return back to work.

Mr McDonald said he, like all the other victims, had hoped for more from the forensic investigation into Walker’s bankrupt estate.

"It's extremely disappointing to say the least,” he said.

“We wanted answers about how this could have happened and what happened to our money, but we got very little.

"It has impacted so many peoples' lives. I try not to let it affect me, but it’s a lot of money."

With the knowledge he was going to jail, Walker killed himself in July 2015 after the Ponzi scheme he had been running for at least 25 years was uncovered. The scheme saw unsuspecting early victims paid bogus profits with money put in by later ones.

According to Mr Tolcher’s bankruptcy trustee report, Walker used $2.8 million of clients’ money between 2002 and 2015 to keep his Ponzi scheme running, paying exit funds and interest payments to victims.

All the while, when he wasn’t on expensive overseas holidays, the veteran accountant was using his Newcastle practice as a front to lure new victims.

He kept charge of their financial records, assuring victims their money was safe in “pooled investment funds” held at major banks or in “blue-chip” real estate deals.

“It is clear however that the deceased operated various trust accounts resembling a Ponzi scheme for over 25 years, whereby he encouraged depositors to place funds in a pooled investment account promising interest and tax benefits,” Mr Tolcher wrote.

“Calls for the return of funds by depositors and interest payments made to depositors were in turn funded by later depositors creating a snowballing liability."

A further $1.85 million of clients’ money was used by Walker to fund a failed managed investment company from 2000 to 2012 that attempted a commercial property development in Adelaide that never eventuated.

Brett Walker, who worked alongside his father for decades, was a co-director of the failed venture.

Now the head of Hunter-based Active Accounting Group, Brett Walker – who was in a partnership with his father from 2000 to 2008 - came under heavy criticism for repeatedly failing to recall details and struggling with his memory during a July public hearing in the Federal Court into the bankrupt estate.

Brett Walker told the court he knew nothing of his father’s fraud and did not see clients coming to the accounting offices every month, as other staff detailed, over decades, to collect envelopes of cash.

Other victims lost large sums of money that Ray Walker pumped into a dud property development in Carrington via the Cosmopolitan Unit Trust.

As simple as Ray Walker’s scam was, tracing the missing millions has been anything but easy.

According to Mr Tolcher's calculations, millions are still missing and cannot be traced.

He said the investigation had been hampered by the “absence of records” and the “inability or unwillingness of banks” to provide transaction details beyond seven years.

After sifting through the wreckage of the estate for two years, he was unable to identify any further money available to creditors.

“I have considered potential legal recovery actions available to the trustee and am presently of the view that litigation is neither commercial or practical in the administration of the estate,” he wrote.

Mortgages held by banks and secured financiers were paid out and the Mr Tolcher’s bill, estimated to be around $300,000, further reduced the available funds.

Legal fees swallowed another $275,000.

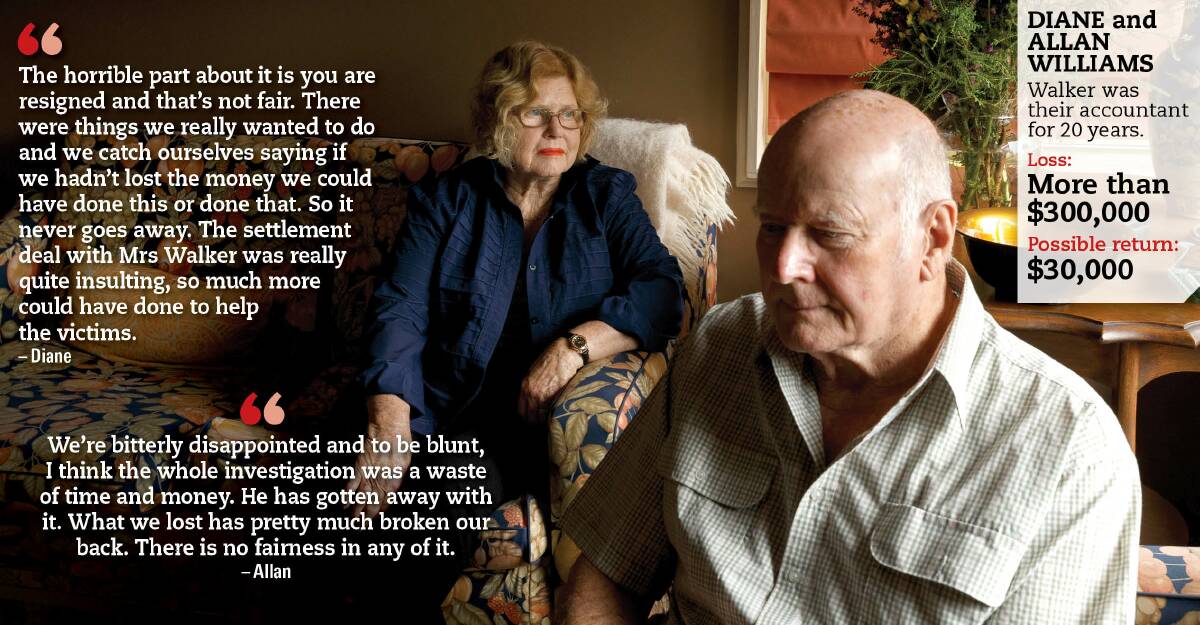

A settlement deal struck by the corporate undertaker with Walker's widow, Jennifer Walker, saw the partial proceeds of two property sales injected into the estate.

In May, Mrs Walker sold the upmarket home she shared with her late husband in Hamilton South for $1.69 million. About half of the proceeds, or Ray Walker's share of the property, was given to the estate.

Further funds were also supplied from the sale of the Walker's beachfront holiday home at Nelson Bay, making a net total contribution of $1.16 million.

But Walker's victims said it wasn't enough.

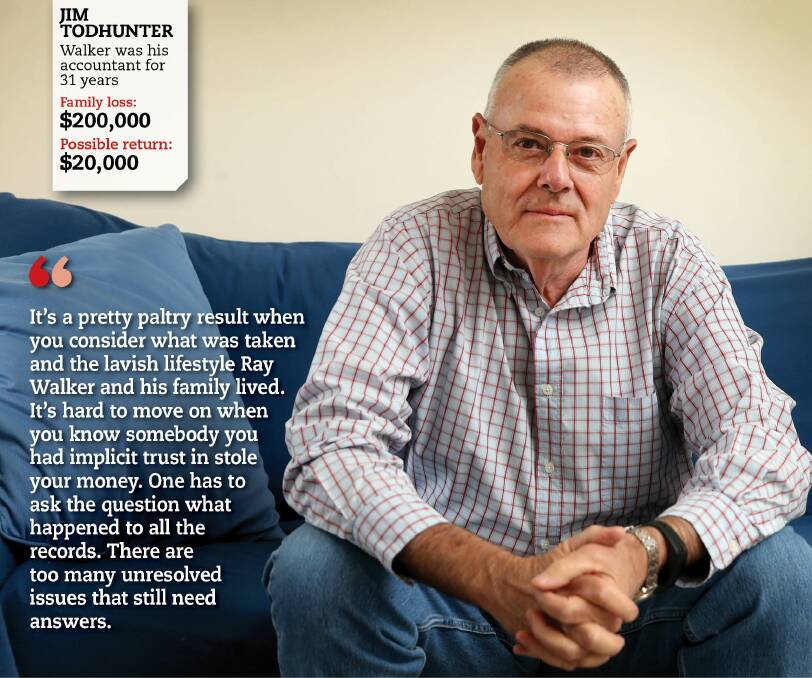

Jim Todhunter, a Newcastle taxi owner-driver, lost $100,000 from his super and another $100,000 he invested on behalf of his daughter who has autism.

“Walker was just a common thief and he lived off the proceeds of stolen money,” he said.

“As much as possible should be returned.”

Victims were also angry that the estate was not given a superannuation fund set up by Ray Walker, worth $282,000, that went to Jennifer Walker due to a binding nomination put in place before Walker died.

They said warning signs that Walker was bank-rolling his lifestyle by pilfering from his clients were visible to authorities and professional bodies, but nobody did anything.

“He was a suburban accountant who was living well beyond his means with expensive houses and cars, holiday homes, overseas trips all the time and private schooling for his children and grandchildren,” Mr Todhunter said.

“One would have to be asking themselves where all the money was coming from.”

Walker’s disciplinary record was marred as far back as the early 1990s for bad conduct when he was brought before the Company Auditors and Liquidators Board where his registration as an auditor was cancelled in October 1992.

He was also banned by the Australian Securities and Investments Commission from managing a corporation for five years from September 1991.

Creditor Diane Leeming, who lost her life savings, said if Walker’s “dodgy past” had been public knowledge, victims would have been spared.

“None of us would have touched him if we knew his record for dishonesty,” she said.

“This is something that should be on a public record that people can access so they know who they are dealing with.”

While you’re with us, did you know The Herald is now offering breaking news alerts, daily email newsletters and more? Keep up-to-date with all the local news - sign up here.