AMERICAN coal company Peabody Energy is again in financial trouble, putting a question mark over its important Australian operations, including the Hunter's Wambo mine and its complex at Wilpinjong, near Mudgee, which exports out of Newcastle.

Subscribe now for unlimited access.

or signup to continue reading

Peabody came out of Chapter 11 bankruptcy protection in the US in April 2017 after restructuring its debts, but sliding coal prices have hit it again financially, and it outlined a series of financing changes this week.

Although it has mines in the US, Peabody's Australian operations are pivotal to its success and Wilpinjong is now regarded as its most profitable asset after an underground fire closed its North Goonyella mine in Queensland two years ago.

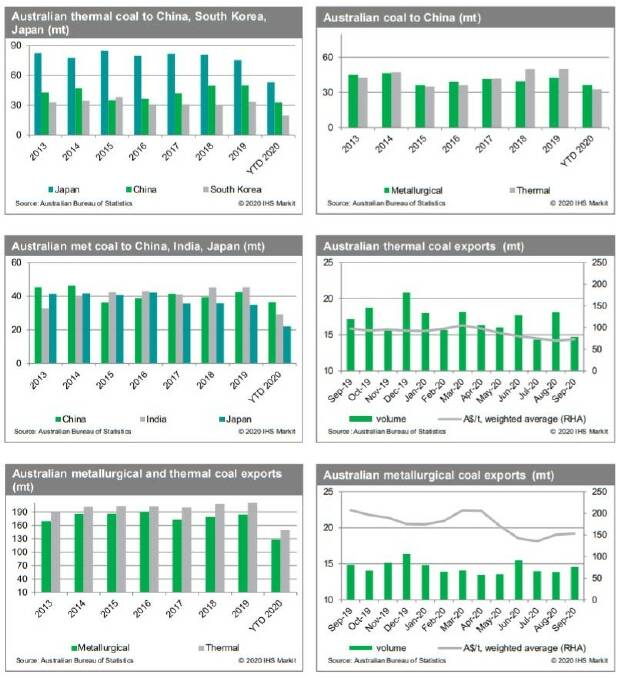

The latest Australian Bureau of Statistics figures show that Australian exports in September were 9.5 per cent down on the same time last year, with COVID-related downturns in demand adding to the growing climate-related pressures on the nation's second-biggest export earner, after iron ore.

Coal experts say the slide is the result of various influences including the politically inspired Chinese import bans on Australian coal.

The latest Australian Coal Report records little trade in one-off or "spot" cargoes of thermal coal out of Newcastle, with prices at about $US56 ($76) a tonne for high quality 6000 kilocalorie product.

High-ash coal of the sort often sold to China was priced at $US39 ($53) at the present exchange rate of 73 cents. Both prices are well down on last year.

Peabody's financial problems are acknowledged in its filings this week to US regulators.

It described Wambo open-cut's contribution as "strong", but said it had shut its Wambo underground for 59 days and needed to cut costs to continue mining past 2021.

Its effort to stay afloat reportedly centres on "ring fencing" the profitable Wilpinjong mine from the rest of the company and using it to raise further capital from lenders.

Peabody's quarterly report said the seaborne coal market (in which Australia is a dominant supplier) was "weak" overall, which continued to put pressure on prices.

India and China had both reduced their imports, with the South East Asian ASEAN countries "the only major importing regions showing sizeable year-over-year growth, with imports up 9 million tonnes year to date through September"

"Longer term, coal is expected to maintain a leading position in the electricity generation mix," Peabody predicts.

"In absolute terms, (thermal) coal is expected to grow while its share of overall generation is expected to decline."

While you're with us, did you know the Newcastle Herald offers breaking news alerts, daily email newsletters and more? Keep up to date with all the local news - sign up here

IN THE NEWS:

- Newcastle Grammar School targeted in cyber attack

- 'Considering options': questions over the future of TAFE's Scone campus

- Newcastle council appeals to Supreme Court after losing Jill Gaynor unfair dismissal case

- Newcastle musician Daniel "Jimmy" Hanson pleads guilty to sexually and indecently assaulting 14 teenage girls and young women

- Woolworths commits to green energy by 2025

- Telstra customers overcharged millions