Best Forex Trading Platforms in Australia: 2024 Guide

This is branded content for PropCompanies.com

As Aussie traders ourselves, we know it's about more than just the basics of a forex broker. We expect narrow spreads, swift execution, and trading platforms with the tools necessary for our success.

Continue reading to uncover our in-depth analysis of the top 10 ASIC-regulated brokers tailored for Australian traders.

- Pepperstone - Best Forex Broker for Automated Trading

- Eightcap - Australian Broker with Low Raw Spreads

- IC Markets - Broker with Low No Commission Spreads

- Fusion Markets - Lowest Commission Forex Broker

- eToro - Best Broker for Copy Trading

- IG - Largest Retail Forex Broker in Australia

- CMC Markets - Best for Share and Forex Trading

- FP Markets - Best MetaTrader 4 Broker

- Plus500 - Best Mobile Trading App

- OANDA - Best Trading Platform for Beginners

The Best Australian Forex Brokers and Trading Platforms

The forex market is ripe with opportunities for Australian traders. Eightcap leads the way with spreads that are, on average, 50% tighter than the industry standard.

Pepperstone is the go-to for automated trading, thanks to its rapid execution speeds that outpace the industry by 42%. IC Markets shines with its low, commission-free spreads.

All brokers are regulated by ASIC, ensuring a legitimate and transparent trading environment. So, no matter your trading priorities, there's a broker on this list that's tailor-made for you.

1. Pepperstone - Best Australian Broker for Automated Trading

Pepperstone is known for offering the best trading platforms thanks to exceptional ECN-like trading conditions and rapid execution speeds, which collectively establish an optimal environment for automated trading strategies.

Pepperstone Pros

- Expert Advisers with MetaTrader 4 and MetaTrader 5

- ECN-like trading conditions and low trading fees

- Ultra-fast execution speeds and minimal slippage

ECN-Like Trading Environment for Automated Trading

If you trade using automations, Pepperstone offers the sophisticated technology that you need. Its rapid order execution and limited slippage render it an optimal choice, particularly for scalping strategies.

Its strategic alliance with Equinix, leveraging the NY4 and LD3 data hubs in New York and London, guarantees minimal latency and slippage-crucial attributes in the realm of automated trading.

Of particular note is Pepperstone's Razor account. Tailored for high-frequency traders, it features interbank rates and a modest commission fee of AUD 7.00 round-turn.

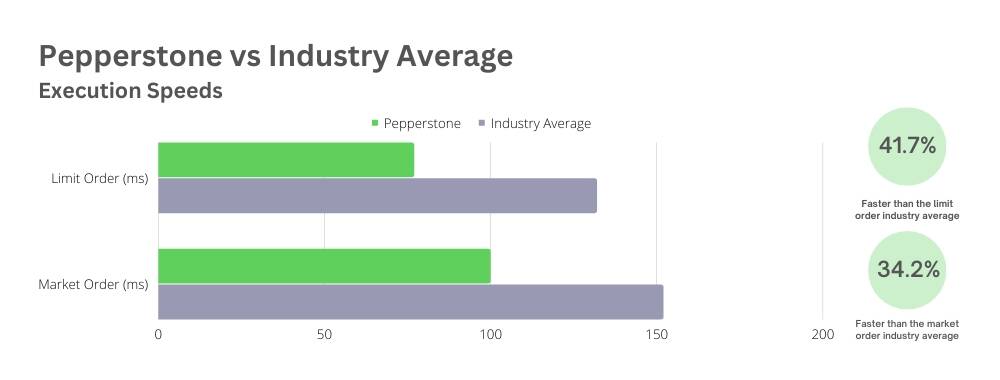

Execution Speeds: A Comparative Analysis

In a comparative analysis of 20 leading brokers, Pepperstone outperformed all but one. It executes limit orders in 77 milliseconds, surpassing the industry average by 42.3%.

For market orders, Pepperstone needed only 100 milliseconds. In the realm of automated trading, this level of speed proves invaluable.

Trading Platforms Tailored for Automated Trading

When it comes to automated trading tools and platforms, Pepperstone delivers. This broker offers a range of forex platforms, each featuring distinctive attributes tailored to algorithmic trading strategies.

MetaTrader 4 (MT4): Remains our preferred choice for automated forex trading, renowned for its comprehensive suite of indicators and Expert Advisors (EAs).

MetaTrader 5 (MT5): A multi-asset platform with advanced charting capabilities, ideally suited for automated trading strategies involving share CFDs and EAs.

cTrader: Geared towards seasoned professionals, characterised by depth of market insights and lightning-fast order processing.

Capitalise.ai: This platform unveils the realm of code-free automated trading, although an MT4 account is a prerequisite.

TradingView: A web-centric platform featuring advanced charting tools and fostering a vibrant social community for strategic discussions and knowledge sharing.

Expert Advisers for Automated Trading

Pepperstone's Smart Trader Tools will appeal to those who heavily rely on Expert Advisors. Available on both MetaTrader 4 and MetaTrader 5, this suite of 28 smart trading apps is designed to optimise the performance of your EA.

Ross Collins from CompareForexBrokers.com discusses Pepperstone's automated trading offering.

"One standout feature is the Trade Simulator, which allows you to backtest your EAs using real market data on the MT4 platform. This is invaluable for fine-tuning your algorithmic strategies before putting them to the test in live markets. With superior execution speeds which are crucial for EAs that operate on scalping or high-frequency trading strategies, Pepperstone provides a superior automated trading environment."

Pepperstone Cons

- No proprietary platform

- Standard Account pricing less competitive

The Razor account stands out with its narrow spreads, averaging 0.1 pips for EUR/USD. The Standard Account, however, starts at 1 pip.

Pepperstone Overall

Pepperstone emerges as a top choice for traders who value speed and precision. With execution speeds that significantly outpace the industry average, this broker is particularly well-suited to automated traders and those who trade in high volumes.

- Prime environment for automated trading with Expert Advisors

- ECN-like trading conditions with ultra-fast execution speeds

- A comprehensive range of trading platforms including MetaTrader 4 and MetaTrader 5

Pepperstone is regulated in multiple jurisdictions including ASIC in Australia and the Financial Conduct Authority (FCA) in the UK.

2. Eightcap - Australian Forex Broker with Low Raw Spreads

Eightcap distinguishes itself with spreads that outpace the industry by 50%, reliable MetaTrader platforms, and an expansive range of CFDs.

Eightcap Perks

Spreads that beat the market by 50% on average

MetaTrader 4 and MetaTrader 5 trading platforms

Diverse CFDs with 40 forex pairs and cryptocurrencies

Ultra-Tight Forex Spreads

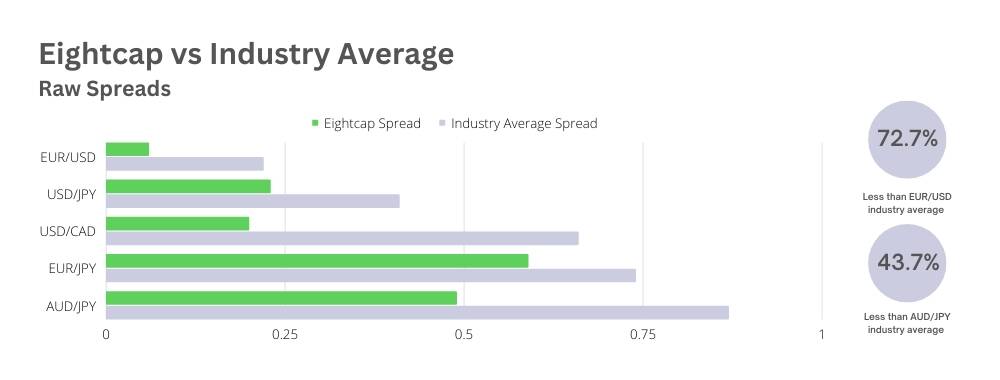

When it comes to forex trading, every pip counts. Eightcap's Raw Account offers some of the best spreads in the industry. Whether you're trading Euro vs US Dollar (EUR/USD) or venturing into more exotic pairs like the Australian Dollar vs Japanese Yen (AUD/JPY), Eightcap consistently offers spreads 50% better than the industry standard.

As a starting point, we looked at two commonly traded pairs. With Eightcap, the EUR/USD spread is 0.06 pips - 72.7% better than the industry average of 0.22 pips. For the popular forex pair AUD/JPY Eightcap's 0.49 pip spread is 43.7% better than the industry's 0.87 pips.

Even with less popular pairs, Eightcap outperforms similar brokers. If you're trading minor pairs, Eightcap has got you covered. The usd/JPY raw spread of 0.23 pips is 43.9% better than the industry average of 0.41 pips. In the USD/CAD market, they offer a 0.20 pip spread, outperforming the industry average of 0.66 pips by 69.7%.

Eightcap's Raw Account Type

Eightcap's Raw Account makes for a compelling option for traders looking to optimise their trading costs. Unlike the Standard Account, which has higher spreads and built-in commissions, the Raw Account offers lower spreads and charges $7 AUD round turn in commission.

Justin Grossbard from CompareForexBrokers.com explains how the Raw Account is advantageous for experienced traders.

This account is crafted for those who've mastered the art of forex trading and are willing to pay a commission for the privilege of razor-thin spreads. The spreads here are as close to the bone as you can get, mirroring the quotes from liquidity providers

- Justin Grossbard, CompareForexBrokers.com.

For high-volume traders, where every pip counts towards the bottom line, the tight spreads have a significant impact on profits.

MetaTrader 4 and MetaTrader 5 Trading Platforms

When it comes to trading platforms, Eightcap stands out for its commitment to quality. It offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular, well-supported tools available today.

- MT4 boasts essential features, including Expert Advisors for automation, diverse chart types, and real-time price monitoring.

- MT5 expands its horizons beyond forex, providing 21 timeframes and accommodating six pending orders, showcasing its versatility as a trading platform. Additionally, its up-to-the-minute market updates and economic news keep traders consistently informed.

Range of Financial Markets and CFDs

In terms of trading diversity, Eightcap offers a wide range of options. Whether your focus lies in forex or commodities, this broker provides an extensive selection.

Forex Trading:

Eightcap goes beyond the basics with an impressive offering of 40 currency pairs. In addition to standards like EUR/USD and GBP/USD Eightcap distinguishes itself with unique options like USD/TRY.

Commodities:

Interested in trading silver, natural gas, or agricultural commodities like wheat and coffee? You can with Eightcap.

Indices and Shares:

Eightcap grants access to prominent global indices such as the S&P 500, FTSE 100, and Nikkei 225. For those inclined towards individual stocks, Eightcap offers the option to trade CFDs on major companies like Apple, Amazon, and Tesla.

Cryptocurrencies:

Acknowledging the rise of digital assets, Eightcap incorporates cryptocurrencies into its offerings. Whether you prefer Bitcoin, Ethereum, or lesser-known cryptocurrencies, this broker has you covered.

Eightcap Cons

- Limited educational materials for beginners

- No proprietary trading platform

For those just dipping their toes into the forex trading waters, Eightcap's educational resources may appear limited. The platform contains a limited suite of tutorials or webinars, which might need fixing for traders eager to broaden their market knowledge.

Furthermore, it has yet to develop a proprietary trading platform. This absence might be a sticking point for traders who lean towards a distinctive, tailored trading environment.

Eightcap Overall

Eightcap stands out as a top choice for traders who prioritise competitive spreads and a wide range of trading options. With spreads that surpass the industry benchmark by an impressive 50%, it's a platform where every pip truly counts.

- Competitive spreads that outperform the industry average

- Access to both MetaTrader 4 and MetaTrader 5

- A wide range of CFDs including forex pairs and cryptocurrencies

Eightcap is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a secure and transparent trading environment.

3. IC Markets - Lowest Spreads with No Commission Fees

IC Markets emerges as a strong contender in a trading arena where every pip matters. This Sydney-based broker has made its mark by consistently offering some of the tightest spreads.

IC Markets Perks

- Commission-free EUR/USD spreads on average 50% less than the industry average

- Low fees and minimum deposit requirements

- MetaTrader 4 for no commission forex trading

The Lowest Commission-Free Spreads

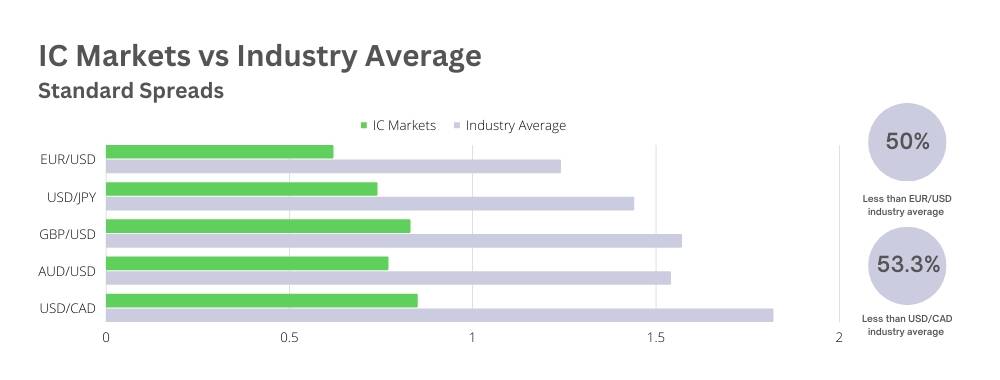

A close inspection of the numbers brings IC Markets' superiority into sharp relief. consider the EUR/USD forex pair; IC Markets offers spreads of 0.62 pips - 50% lower than the industry average of 1.24 pips.

It's a similar story with the USD/JPY pair, where IC Markets offers 0.74 pips, undercutting the industry average of 1.44 pips by nearly 49%.

The GBP/USD and AUD/USD pairs also follow this trend, with IC Markets offering spreads of 0.83 pips and 0.77 pips respectively. These are significantly lower than the industry averages, which stand at 1.57 for GBP/USD and 1.54 pips for AUD/USD, marking a difference of around 47% and 50%.

IC Markets Standard Account Type

The commission-free structure of the Standard Account simplifies the trading process with a straightforward pricing structure. This means you can focus more on perfecting your trading instead of getting your head around tricky fee setups.

Additionally, IC Markets offers a range of deposit and withdrawal options, including credit/debit cards, bank transfers, and various e-wallets like PayPal and Skrill, providing both convenience and flexibility for your financial transactions.

Demo Accounts for Beginners

IC Markets offers an unlimited demo account, a feature that sets it apart from many other brokers. Through the demo account, we've been able to trial various trading tactics, familiarise ourselves with the trading platforms they provide, and discern the behaviour of different financial instruments.

Generously funded with virtual money, demo accounts replicate real-time market scenarios found in a live trading account. This imparts a genuine trading experience, indispensable for both acquiring new knowledge and refining existing trading techniques.

IC Markets Cons

- No proprietary mobile app

- Could expand their educational resources

We've noticed that IC Markets leans on third-party platforms such as MT4, MT5, and cTrader, unlike several brokers who offer their own proprietary trading apps. Additionally, while IC Markets does provide some educational resources, they are not as comprehensive as what some other brokers offer.

IC Markets Overall

Where IC Markets truly shines for us is its appeal to those keen on curtailing trading expenses, especially when trading commission-free spreads. Given that their forex spreads consistently undercut the industry average for major currency pairs, IC Markets emerges as a top pick for traders with an eye on costs.

- Commission-free spreads

- Accessible and user-friendly Standard Account

IC Markets is regulated by the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC).

4. Fusion Markets - Lowest Commission Forex Broker

Fusion Markets distinguishes itself for individuals within the forex trading community who prioritise cost-efficiency. Its commission fees are substantially lower than the industry norm, and the broker does not charge deposit or withdrawal fees or require a minimum deposit.

Fusion Markets Perks:

- Commission fees 26-35% less than the industry average

- Low trading costs with zero deposit or withdrawals fees

- No minimum deposit

Commission Fees Below the Industry Average

At just $2.25 AUD per trade, Fusion Markets significantly undercuts the industry average of $3.34 AUD by a substantial 32.6%.

For instance, EightCap, Pepperstone, and IC Markets all charge AUD 3.50. Even CMC Markets, which is known for its competitive pricing, charges a slightly higher AUD 2.50.

Range of Trading Platforms

When we looked into the platform options provided by Fusion Markets, we were met with a comprehensive suite. They offer MetaTrader 4 and MetaTrader 5, which are industry staples known for their reliability and extensive features.

It's clear that Fusion Markets has put thought into their platform selection, aiming to cater to traders across the spectrum, from novices to seasoned pros. With such a diverse range of platforms, you're bound to find one that aligns with your trading needs.

Fusion Markets Cons

- Inactivity fee after 12 months of dormancy

- Limited selection of share CFDs

In terms of downsides, there are a few areas where Fusion Markets might not fully cater to everyone's needs. One of the charges to be mindful of is the inactivity fee. Fusion Markets imposes a fee of $10 per month on accounts that remain dormant for over a year.

Another aspect we've picked up on is their limited array of share CFDs. Fusion Markets provides only 100 share CFDs, which pales in comparison to the extensive range offered by competitors like IG and eToro.

Fusion Markets Overall

Fusion Markets is a great option for those focused on reducing trading costs without compromising on service quality.

- Commission fees 26-35% less than the industry average

- No minimum deposit requirement

- A diverse range of trading platforms

Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a secure and transparent trading environment.

5. eToro - Best Broker for Copy Trading

Established in 2007, eToro has carved a unique niche in the forex trading landscape, particularly in the realm of social and copy trading. Here's our take on why eToro stands tall as the preferred platform for copy trading.

eToro Markets Perks

- Millions of users in 140+ countries

- CopyTrader and CopyPortfolio tools

- Incentives for experienced traders

A Community of Traders at Your Fingertips

eToro was one of the first brokers to fully embrace social trading, a concept that allows traders to interact, share strategies, and even copy each other's trades. With 30 million users across more than 140 countries, you're spoilt for choice.

Moreover, eToro's platform is enriched with numerous filters - from geographical location to risk appetite - facilitating dynamic engagement with peers and strategy exchanges.

CopyTrader and CopyPortfolio Trading Tools

The heart of eToro's copy trading lies in its two key features: CopyTrader and CopyPortfolio.

CopyTrader allows you to replicate the strategies of your chosen traders automatically. CopyPortfolio, on the other hand, lets you invest in multiple markets by copying a portfolio of traders or assets.

These tools make it incredibly easy for you to diversify your investments while learning from the best in the business.

Incentives for Top Traders

eToro goes the extra mile to encourage top traders to share their strategies. If you're an experienced trader, you can earn additional profits as high as 2% of assets under management as rewards for having copiers.

eToro Cons

- Customer support not comprehensive

- Higher spreads than other top brokers starting from 1 pip

While eToro offers a range of customer support options, the absence of a dedicated account manager and the lack of a contact number are notable drawbacks. The platform encourages users to visit the help centre or open a ticket for support, but this doesn't quite measure up to the personalised service offered by its Australian counterparts.

Lastly, eToro's fee structure is built around higher spreads, starting from 1 pip.

eToro Overall

eToro emerges as the frontrunner for traders keen on copy trading through a strong social trading network.

- Social trading ecosystem for real-time interaction and strategy sharing

- Automated trading solutions for hands-free portfolio management

- Financial incentives that reward community participation

Headquartered in Tel Aviv, Israel, eToro has a global presence with registered offices in Cyprus, the United Kingdom, the United States, and Australia. The firm is regulated in multiple jurisdictions, including CySEC in the EU, FCA in the UK, and FinCEN in the United States.

6. IG - Largest Retail Forex Broker in Australia

With a global footprint and a diverse range of offerings, IG is the go-to broker for traders looking for a comprehensive trading experience.

IG Perks

- A comprehensive selection of CFDs and diverse asset classes

- Cutting-edge technical analysis and market research tools

Global Forex and CFD Broker

Established in 1974, IG Markets has evolved beyond being just another broker - it's an institution in its own right. Over nearly five decades, they've continuously adapted to evolving market dynamics to provide an unparalleled trading experience.

Diverse Market Access

The online broker boasts an extensive range of CFDs and asset classes, making it a one-stop-shop for traders. IG offers over 17,000 markets to trade - from forex pairs and indices to commodities and equities.

Whether you're interested in trading traditional markets like forex and commodities or looking to venture into newer asset classes like cryptocurrencies and thematic stocks, IG has something for everyone.

Trading Platforms and Technical Analysis Tools

When evaluating the trading platforms, IG Markets doesn't disappoint. They offer their proprietary 'core platform,' which is user-friendly and packed with features.

For traders who prefer something more familiar, they also provide access to MetaTrader 4. Both platforms come equipped with a host of free tools to enhance your trading experience.

IG's trading tools include:

- Reuters news streaming for real-time market analysis and insights.

- Features like Autochartist and Trading Central for real-time market scans and opportunity identification.

- Extensive range of indicators, drawing tools, and customisable charts for in-depth market analysis.

IG Cons

- Limited cryptocurrency CFDs

- Inactivity fees if you don't trade for an extended period

If you're keen on diversifying your portfolio with a variety of cryptocurrency CFDs, IG might not be the best fit for you; their crypto features are somewhat limited.

Infrequent trader? Be prepared for inactivity fees. Similar to many top brokers, IG charges a fee if your account remains dormant for an extended period, which can eat into your capital.

IG Overall

With a wide array of trading platforms and a comprehensive range of assets, IG Markets is a top choice for traders aiming for portfolio diversification and advanced market analysis.

- Long-standing reputation

- Diverse market access

- Advanced technical analysis tools

Headquartered in London, IG Markets is regulated in multiple jurisdictions, including the FCA in the UK and ASIC in Australia.

7. CMC Markets - Best for Share and Forex Trading

CMC Markets boasts a comprehensive range of over 10,000 CFD products, ranging from forex to shares and cryptocurrencies.

CMC Markets Perks

- 35,000 physical shares and 10,000 share CFDs

- More than 330 forex pairs

- Multiple platforms for forex and CFD trading

Extensive Share Market Access

We found CMC Markets' dedicated share trading platform comprehensive, letting us trade real shares, separate from their CFD trading services.

We also trialled their innovative Next Generation platform. What stood out to us was their clear commission structure for share CFDs, starting at a mere 0.04%.

Diverse Currency Trading

With CMC Markets, we could choose from major pairs like EUR/USD and AUD/USD, as well as more exotic and minor pairs such as EUR/TRY and USD/RUB.

This extensive range of currency pairs, combined with flexible leverage options, has cemented CMC Markets as one of our top choices for forex trading for both novice and experienced forex traders.

CMC Markets Cons

Wider spreads than other brokers

Inactivity fee if you don't trade frequently

One aspect of CMC Markets we've noted is their relatively wider spreads compared to brokers like Eightcap and Pepperstone. This might translate to slightly elevated costs for traders.

Another point of contention is the inactivity fee. If you're not an active trader, you'll find yourself facing charges just for keeping your account open.

CMC Markets Overall

CMC Markets provides an extensive selection of trading products and a variety of platforms. We consider it a primary destination when looking to diversify our trading portfolios across multiple asset categories.

- Over three decades of industry experience

- Over 35,000 physical shares and 10,000 share CFDs

- More than 330 forex pairs

Headquartered in London, CMC Markets is regulated by top-tier authorities like the FCA in the UK and ASIC in Australia

8. FP Markets - Best MetaTrader 4 Broker

FP Markets is an ASIC-regulated, Sydney-based broker and a top choice for those keen on leveraging the power of MetaTrader 4.

FP Markets Perks

- MetaTrader 4, plus advanced trading tools

- One click trading and customisable alerts

MetaTrader 4 Forex Platform

Our journey with FP Markets' MetaTrader 4 has been marked by its adaptability and ease of use. We've appreciated the freedom to tweak the interface to our preferences. Whether we've been on a PC, Mac, iOS or Android, FP Markets has consistently delivered.

The one-click trading feature particularly stood out for us, especially for quick execution

Key Features for Technical Analysis

FP Markets has enriched our MT4 trading journey with advanced charting tools, live price charts, and timely market news.

- Customisable Interface: MT4 lets you adjust indicator colours for better visual data interpretation.

- Expert Advisors (EAs): MT4 supports EAs, enabling fast execution, a boon with FP Markets.

- Custom Alerts: Set alerts for precise market condition notifications, ensuring you catch every trading opportunity.

- MetaTrader Market and MQL4 Community Access: Gain access to custom indicators and automated trading scripts through this valuable resource.

FP Markets Cons

- Limited asset diversity on MetaTrader 4

- Not the best pick for beginner traders

Despite its many strengths, we've identified a few areas where FP Markets could improve. For those keen on trading ETFs or share CFDs, it was a letdown to realise these weren't accessible on their MetaTrader 4 platform.

Secondly, FP Markets may not be the best fit for beginner traders. The platform's extensive features and tools can be overwhelming for those who are new to trading.

FP Markets Overall

FP Markets has carved out a niche for itself as a leading MetaTrader 4 broker, demonstrating a strong commitment to providing advanced trading tools and a user-centric experience.

- MetaTrader 4 platform with advanced trading tools

- One-click trading and customisable alerts

- Access to the MQL4 marketplace and community

Headquartered in Sydney, Australia, FP Markets is regulated by the Australian Securities and Investments Commission (ASIC).

9. Plus500 - Best Mobile Trading App

Plus500 is your answer if you're in search of a broker that excels in mobile trading. The intuitive mobile app and its relatively low entry threshold make this broker an attractive choice for beginners.

Plus500 Perks

- Easy to use mobile trading apps for iOS and Android

- No fees for deposits

User-Friendly Mobile App

Plus500's proprietary app syncs beautifully across different devices, and we've particularly enjoyed its performance on our Android and iOS mobiles.

One of the standout features for us has been the app's sleek, clutter-free interface. Couple that with real-time quotes on stock and forex pairs, and you have a tool perfectly designed for sharp technical analyses and strategy formulation. While the platform focuses on 'no frills' trading, it provides all the essential information required for making a trade, right at your fingertips.

Seamless Deposits

We've successfully used various methods, from credit cards like Mastercard and Visa to e-wallet options like PayPal and Skrill to fund our accounts. For those of us partial to traditional methods, bank wire transfers were also feasible.

The multi-base currency support has been a standout feature, especially for those keen to sidestep conversion fees. Being able to trade in our local currency made it more economical.

Plus500 Cons

- No instant customer support

- Mobile app lacks features for advanced traders

A downside we've encountered with Plus500 is the absence of immediate contact support. While they have email and live chat avenues, the missing direct phone line stands out.

Secondly, Plus500's forex platform and mobile app may be too restrictive for expert traders who require advanced features.

Plus500 Overall

Plus500 has cemented its reputation as our top pick for mobile trading. Its mobile app, compatible with both iOS and Android, truly stands out in terms of usability.

- User-friendly mobile app compatible with iOS and Android

- Low minimum deposit and no withdrawal fees

- Multiple base currencies supported

Though it might fall short in catering to the nuanced needs of veteran traders, Plus500 excels in offering a seamless and efficient trading journey.

Headquartered in Israel, Plus500 is regulated by top-tier authorities like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

10. OANDA - Best Trading Platform for Beginners

For those of you just starting out in the forex trading realm, OANDA is a name you should consider. With platforms that are easy to navigate and an abundance of educational tools, OANDA is an excellent place for newcomers to set out and evolve in the trading arena.

OANDA Perks

- Intuitive, user-friendly platforms

- Live, interactive webinars for real-time learning and Q&A

Versatile Forex Trading Platforms

Diving into OANDA's trading interface, we were immediately taken by its straightforward design. It's incredibly beginner-friendly, easing the initial apprehension that many of us face when stepping into forex trading for the first time.

OANDA offers not just one but three trading platforms: OANDA Trade, MetaTrader 4, and TradingView. Whether you're a desktop trader or someone who likes to keep tabs on the market while on the move, OANDA has got you covered. We've tried their mobile app, and it's as functional as their desktop platform.

Comprehensive Educational Resources for Beginner Forex Traders

The depth and scope of OANDA's educational resources surpasses the typical glossaries and FAQs of many platforms.

Justin Grossbard from CompareForexBrokers.com adds his two cents about the brokers extensive educational materials.

OANDA provides a broad range of research tools and educational materials that are incredibly beneficial for newcomers. Their MarketPulse site is a treasure trove of articles, updated multiple times a day, covering everything from market trends to trading strategies. This is complemented by an online course that covers the basics of both fundamental and technical analysis. Topics range from getting started and understanding market dynamics to mastering trading strategies and capital management, it's a really great resource for beginner traders learning the ropes.

- Justin Grossbard from CompareForexBrokers.com

We especially appreciate OANDA's webinars. These are not just pre-recorded sessions. They're live, interactive events where you can ask questions and get real-time answers. This is a fantastic way for beginners to get a grasp of complex trading concepts.

OANDA Cons

Financial product offering does not include share CFDs

No swap-free account type

While OANDA excels in forex and cryptocurrency trading, it falls short when it comes to share CFDs. This limitation could be a deal-breaker for traders seeking a one-stop-shop for all their trading needs.

Unfortunately, OANDA doesn't offer a swap-free account type for Islamic traders. This could be a significant drawback for those who require an account that complies with Sharia law.

OANDA Overall

OANDA's educational content isn't just expansive but also highly interactive, transforming the process of learning about forex trading into an immersive journey.

- Intuitive and user-friendly trading platforms

- Multiple trading platforms to choose from

- Comprehensive educational resources

Headquartered in the United States, OANDA is regulated by top-tier authorities like the Commodity Futures Trading Commission (CFTC) in the U.S. and the Financial Conduct Authority (FCA) in the UK.

What is CFD Trading?

CFD trading, or Contract for Difference trading, is a way to speculate on financial markets without owning the underlying asset. It allows you to potentially profit or incur losses based on the price movements of assets like forex, commodities, and indices.

How Big is the Forex Market?

The forex market is colossal, boasting an estimated valuation of $1.93 quadrillion and a daily trading volume of $7.5 trillion as of April 2022. To give you an idea of its magnitude, it's 30 times the size of the combined US stock and bond markets. This immense scale provides traders with unmatched opportunities for both profit-making and portfolio diversification.

Who are the Australian Securities and Investment Commission (ASIC)?

The Australian Securities and Investment Commission (ASIC) is the regulatory body overseeing Australian financial services, including the Foreign Exchange market. They are responsible for issuing Australian Financial Services Licences (AFSL) and ensuring financial markets operate fairly and transparently. ASIC plays a crucial role in mitigating high-risk trading activities and protecting both professional traders and retail investor accounts from scams, particularly in the derivatives market.

Examples of other financial regulators include the FMA in New Zealand, CIRO in Canada, CySEC in Europe, and the FCA in the UK.

How Do I Start Trading Forex?

To start trading forex as an Australian, first choose an ASIC-regulated broker that suits your needs. Register and submit the required ID for verification. Once verified, deposit funds into your account. Many brokers offer demo accounts, so take advantage of this to practise before going live. Once you're comfortable, you can start live trading.

Keep in mind that online trading comes with high risk due to the inherent volatility of financial markets such as forex. To reduce the high risk of trading CFDs and forex, ensure you sign up to a reputable and regulated broker, as well as implementing strong risk management tactics.

When signing up to a new brokerage, be sure to read all disclaimers and research the protections the broker offers to retail investor accounts.

This information is of a general nature only and should not be regarded as specific to any particular situation. Readers are encouraged to seek appropriate professional advice based on their personal circumstances.

Disclaimer: This story may include affiliate links with PropCompanies partners who may be provided with compensation if you click through. ACM advises readers consider their own circumstances and needs. You should verify the nature of any product or service, and consult with the relevant regulators' website before making any decision.